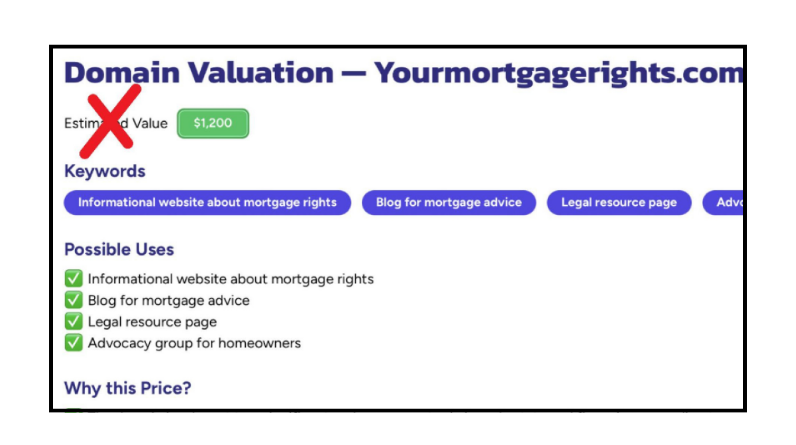

The name YourMortgageRights.com immediately communicates a focus on educating homeowners about their rights, protections, and options when it comes to mortgages. “Mortgage” points to the core subject—home loans—while “Rights” emphasizes the legal entitlements and protections homeowners have, often in the face of financial difficulty or mortgage-related challenges. Whether you’re a homeowner struggling to make payments, navigating foreclosure, or simply looking for advice on mortgage regulations, YourMortgageRights.com would serve as a trusted resource to ensure homeowners understand their legal rights and take the appropriate actions. But what would someone searching for YourMortgageRights.com expect to find, and what does this name suggest about the mission behind the website?

A Resource for Understanding Mortgage Rights and Protections

At its core, YourMortgageRights.com would be a comprehensive platform dedicated to educating homeowners about their legal rights in relation to mortgages. The site would break down complex mortgage laws, explain the rights of borrowers, and provide information on how to protect those rights in various situations.

Visitors could expect to find content related to the most common mortgage issues faced by homeowners, including understanding mortgage contracts, dealing with predatory lending practices, and navigating the foreclosure process. The site would provide clear, accessible explanations of the legal frameworks surrounding mortgages, helping homeowners understand their rights in terms of payments, loan modifications, and options for resolving mortgage-related issues.

Homeowner Protection and Legal Rights in Foreclosure

One of the central themes of YourMortgageRights.com would be providing guidance to homeowners facing foreclosure. The website would offer step-by-step guides on how homeowners can protect themselves from foreclosure and explore all available options for avoiding losing their home.

The site would cover the rights homeowners have during the foreclosure process, such as the right to receive notice before foreclosure begins, the ability to challenge improper practices, and the opportunity to negotiate a mortgage modification or repayment plan. Additionally, YourMortgageRights.com could provide information on what to do if foreclosure proceedings have already started, including legal options like filing for bankruptcy, seeking a loan modification, or pursuing foreclosure mediation.

The website would also highlight government programs and resources available to help homeowners avoid foreclosure, such as the Home Affordable Modification Program (HAMP), and other state and federal initiatives. Visitors would find links to reputable organizations that can offer financial counseling and support to those facing foreclosure.

Mortgage Modification and Refinancing Options

For homeowners looking to improve their mortgage situation, YourMortgageRights.com would offer valuable information on mortgage modifications and refinancing options. The site could explain what a mortgage modification is, how it works, and when it’s a viable option for those struggling with their mortgage payments.

Homeowners would find advice on how to apply for a mortgage modification, what to expect during the process, and how to negotiate with lenders for more favorable terms. YourMortgageRights.com would also cover the pros and cons of refinancing, explaining how refinancing can help lower monthly payments or consolidate debt, and provide tips on how to secure the best refinancing deals.

Additionally, the site could offer expert insights on dealing with common issues that arise during these processes, such as qualifying for a modification, managing paperwork, and avoiding potential scams from predatory lenders.

Dealing with Predatory Lending and Unfair Practices

YourMortgageRights.com would also focus on protecting homeowners from predatory lending practices and other unfair activities that may violate their rights. Many homeowners may not be aware that they are being targeted by unscrupulous lenders who offer high-interest loans or terms that are not in their best interest.

The website could educate homeowners about how to recognize predatory lending, including warning signs such as high fees, unrealistic promises, and loans that place excessive financial burden on the borrower. YourMortgageRights.comwould provide resources on how to file complaints against unfair lenders, report fraud, and seek legal recourse if they have been victimized by predatory practices.

Visitors could also find information about the legal protections available to them under the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA), which help ensure transparency and fairness in mortgage transactions.

Legal Assistance and Representation for Mortgage Issues

One of the standout features of YourMortgageRights.com would be its emphasis on connecting homeowners with legal professionals who specialize in mortgage-related issues. The website could offer a directory of trusted attorneys, legal clinics, and non-profit organizations that assist with mortgage disputes, foreclosure defense, and consumer protection.

For homeowners in need of representation, YourMortgageRights.com would offer resources on how to choose the right legal professional, what to expect during legal proceedings, and how to navigate the complexities of mortgage litigation. The site could also provide access to free or low-cost legal services for low-income homeowners who may not otherwise be able to afford legal representation.

Mortgage Bankruptcy and Debt Relief

Another critical area of focus for YourMortgageRights.com would be providing guidance on how homeowners can use bankruptcy as a tool for managing mortgage debt. The website would explain the various types of bankruptcy—Chapter 7 and Chapter 13—and how each one can affect mortgage payments, foreclosure proceedings, and property rights.

YourMortgageRights.com would provide advice on how filing for bankruptcy can allow homeowners to reorganize their debts, stop foreclosure, or discharge certain debts, helping them get back on track financially. The site would also highlight the potential impact of bankruptcy on credit scores and future homeownership, helping homeowners make informed decisions about whether this is the right option for them.

Tax Implications and Mortgage Debt Forgiveness

The site would also address important tax considerations for homeowners, such as the tax implications of mortgage forgiveness and the cancellation of debt. Many homeowners who go through a mortgage modification or receive debt forgiveness may not be aware of the potential tax liability that can arise from having their debt canceled or reduced.

YourMortgageRights.com would provide explanations of the tax rules surrounding mortgage debt forgiveness and how homeowners can mitigate tax consequences. The site might offer advice on working with tax professionals to understand their liabilities and take advantage of relief programs like the Mortgage Forgiveness Debt Relief Act.

The Person Behind YourMortgageRights.com: A Dedication to Homeowner Advocacy

The person behind YourMortgageRights.com would likely be a legal professional, mortgage advisor, or consumer advocate with a strong background in real estate law and homeowner protection. They would have a deep understanding of the legal and financial aspects of mortgage contracts, foreclosure laws, and the rights of homeowners.

Their mission would be to demystify the often complex world of mortgages and provide homeowners with the knowledge and resources they need to protect their homes and make informed decisions. With a strong passion for empowering homeowners, they would ensure that YourMortgageRights.com serves as a trusted, reliable source of information and support.

Conclusion: Empowering Homeowners with Knowledge and Action

YourMortgageRights.com would be an essential platform for homeowners looking to navigate the challenges of mortgage payments, foreclosure, and homeownership rights. Whether you’re seeking to understand your legal protections, explore your options for debt relief, or get advice on mortgage modifications and refinancing, the website would provide comprehensive resources, expert advice, and legal support to help you protect your home. With a focus on educating and empowering homeowners, YourMortgageRights.com would ensure that individuals are informed, prepared, and equipped to handle any mortgage-related challenges that come their way.